Project

Desktop Web App Dashboard Redesign

Role

UX/UI Designer

Timeline

4 hours

Tools

Figma, ChatGPT, Figma Make

Overview

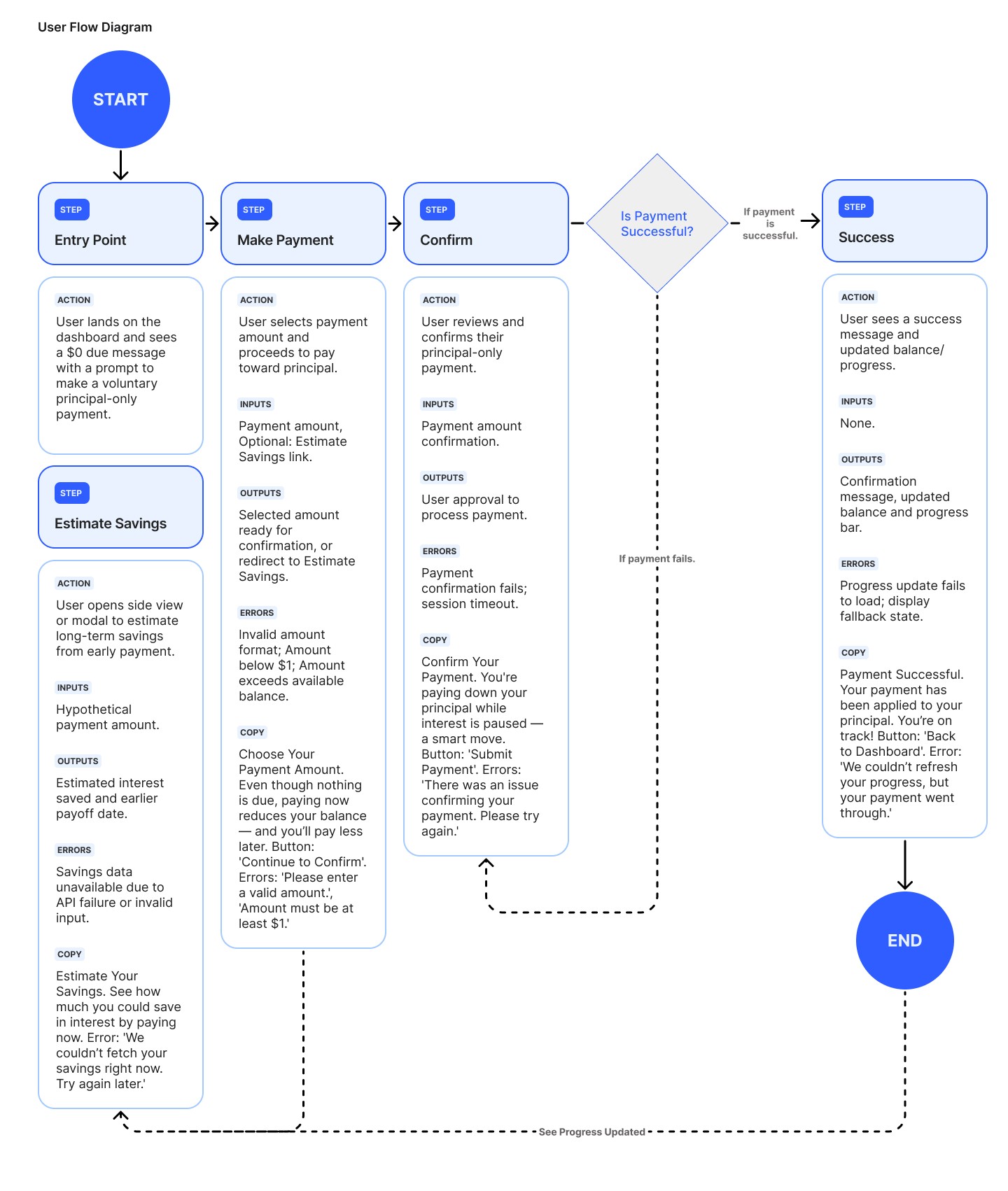

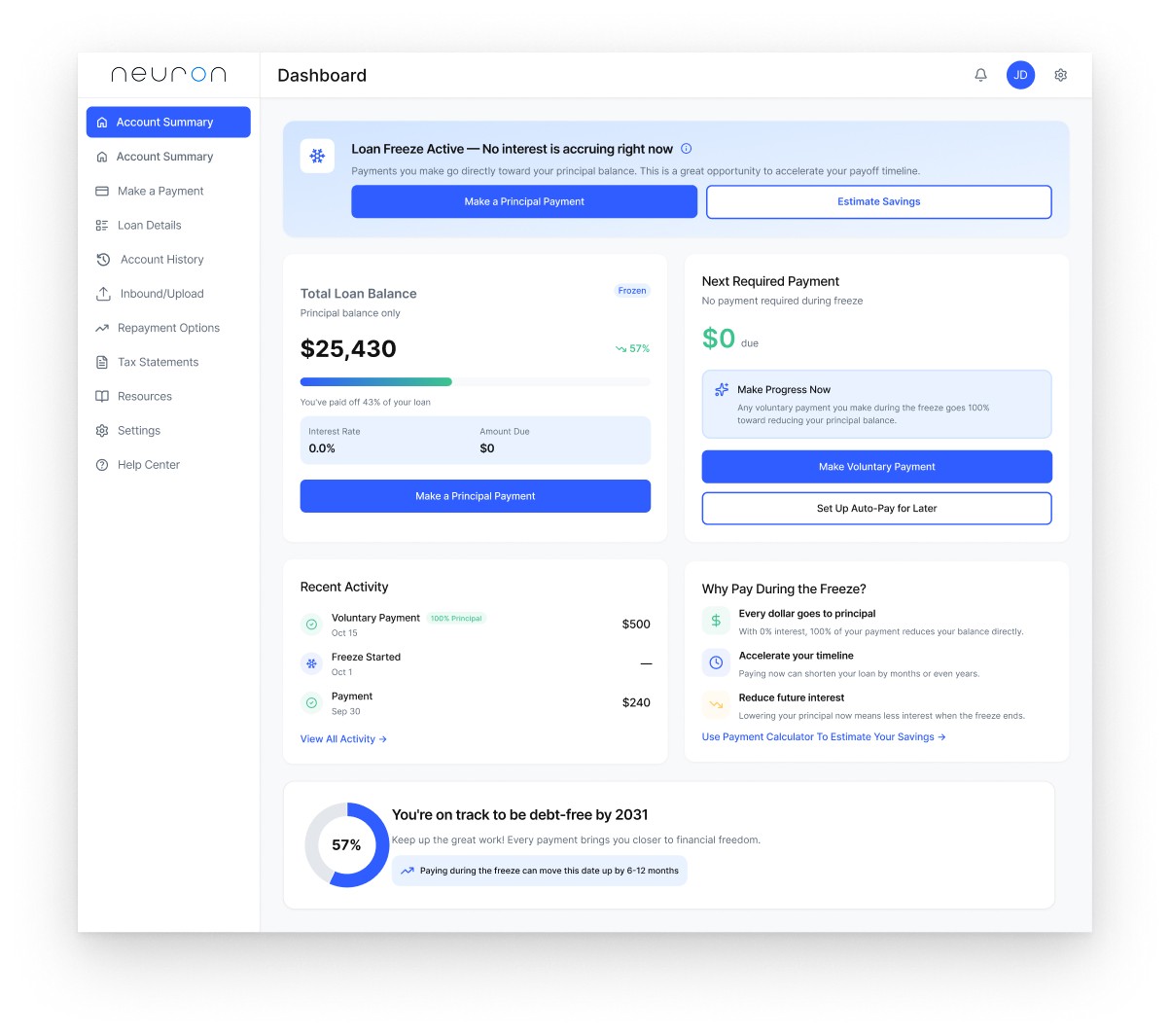

A modern redesign of a student loan portal homepage that communicates clarity, calm, and opportunity. When loans are frozen, users see $0 due but are guided to make principal payments that directly reduce their balance while interest is paused.

In 4 hours, I redesigned the dashboard to deliver instant clarity, emotional reassurance, and optional next steps—supporting both user confidence and business goals.

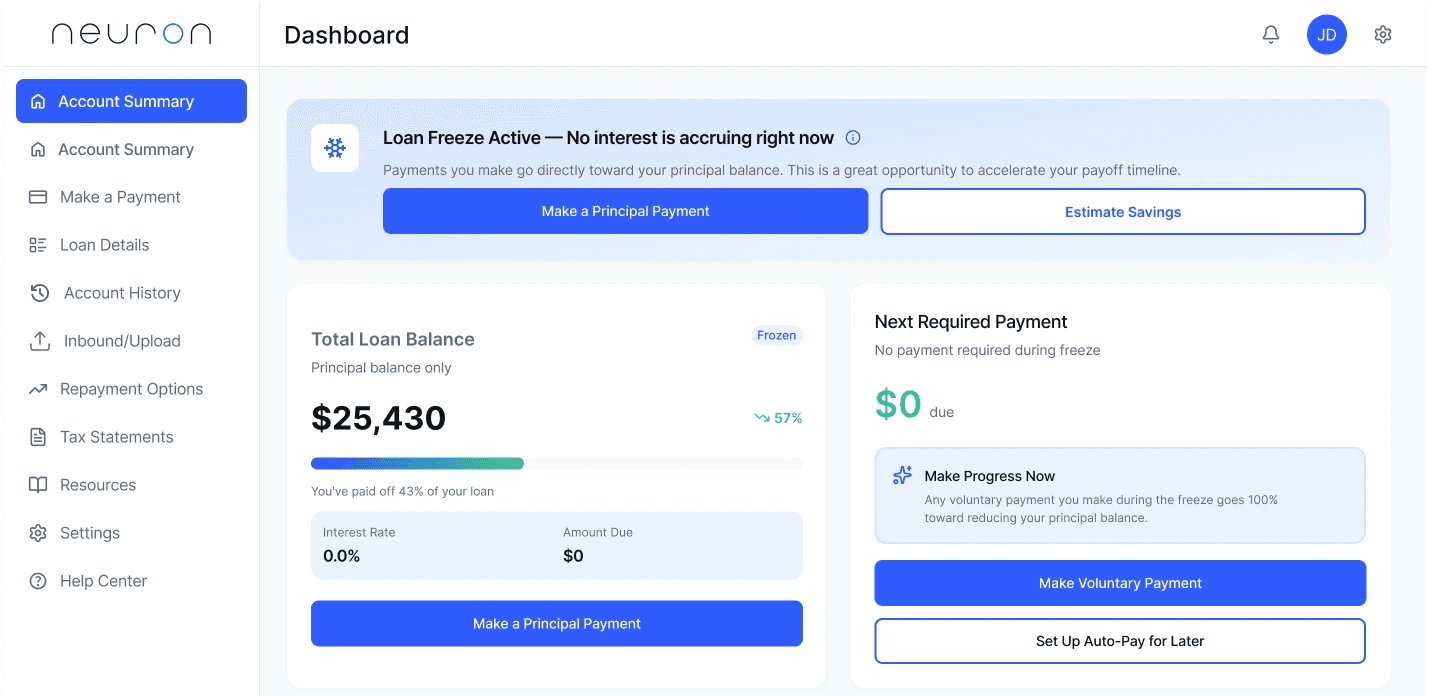

The Problem

Visually dense

Confusing in hierarchy

Missing a clear explanation of 'freeze'

Hard to parse under stress

Design Challenge

Users needed a calmer, clearer starting point.

Their emotional baseline shaped the design direction.

Understanding the Borrower

Neuron UX Design Challenge: Student Loan Dashboard

"What does 'frozen' mean?"

"Do I owe anything right now?"

"Should I act or wait?"

Design Strategy

1

Instant clarity

($0 due, freeze explanation)

2

Reassurance

(tone, spacing, hierarchy)

3

Opportunity

(optional principal payment)

4

Progress

(activity + payoff trajectory)

This drove the card layout and UX hierarchy.

Final Redesign (Highlights)

Key Improvements

$0 due in primary eyepath

Clear 'Loan Freeze Active' messaging

Calm, modern UI with whitespace

Benefit-focused microcopy

Simple CTA hierarchy ('reassure → educate → invite')

Progress ring to reinforce momentum

How AI Helped Me Deliver in 4 Hours

Used AI for

•

Synthesizing the problem quickly

•

Exploring microcopy directions

•

Accelerating early framing

•

Generating case study structure

Handled manually

•

IA, UI, and visual hierarchy

•

Layout, spacing, and interactions

•

Final tone and design logic

AI sped up the thinking, not the designing.

Assumptions Made

01

Users understand basic loan concepts

02

Reassurance-first hierarchy reduces anxiety

03

Single-screen layout improves comprehension

04

Optional payoff projections increase engagement

05

Data needed for the UI is available

These assumptions guide the next steps.

Future Iterations

Test freeze messaging + CTA hierarchy

Mobile layout

Tools for 'estimate savings'

Personalized payment suggestions

First-time borrower onboarding

Reflection

This challenge reinforced how clarity, emotional awareness, and smart use of AI can elevate financial UX—especially under tight constraints.